I saw the Netflix miniseries first and I really loved it, I had to read the book. The Series is one of my favorite Nigerian Netflix series ever: Educative, Informative, Engaging, and Funny. Author Arese Ugwu describes the money issues most millennials can relate to – consumerism, retail therapy, fear and misconception about money, societal pressures, and the roles they play in success and failure.

The book presents the basic concepts of earning, budgeting, spending, borrowing, saving, investing as well as the behavioural and emotional aspects of money in a practical way that makes it easy to personalise.

Although Arese wrote the book with women as her primary audience, I found the lessons in the book to be very helpful for all gender. Each chapter in the book and episode in the Netflix series ends with a financial principle/nugget called Smart Money Lessons. The book shares the story of a typical Nigerian millennial that is very relatable, the roller coaster of being a Nigerian or African, black tax, lifestyle decisions that eventually affect our financial future.

The Smart Money Woman revolves around five young women and how they take control of their finances and assets, the series focuses on spending culture of women and how it ultimately affects their finances on the long run, the series also talks about how friendship, peer pressure and societal influence can affect how we spend money, It also features and teaches how women should learn to invest in their themselves amidst romantic and financial losses. 1

Arese is the Founder of smartmoneyafrica.org a personal finance platform for the African millennial. As a contributor to the Guardian newspaper, the host on Guardian TV’s new personal finance show “Your Life Your Money”, and a co-host for “Analyse This” on Ndani TV, she has helped shape the new narrative on personal finance in the media.

Rating – 9/10 (Loved the Book)

The book ends with Arese defining who a smart money woman is, she writes:

She is a combination of the best parts of African women I respect. She has an entrepreneurial mind and sits on several boards like Ibukun Awosika. She is a pioneer of industry and creates jobs like Tara Fela Durotoye and Yewande Zacchaeus. She is fearless like Mo Abudu, who had the guts to pursue a dream of owning her own network regardless of how impossible it seemed. She is committed to raising the next generation of female leaders like Osayi Alile. She shapes the narrative of new African culture like Bolanle Austen-Peters. And, she has the financial mind of women like Nimi Akinkugbe, Arunma Oteh, and Bola Adesola.

She is a woman whose hustle has purpose and has learnt to make money, keep money and grow money. She is a master of her craft, lives by her own playbook, and is in the top ten percent of her industry. She doesn’t worry about whether there’s money in the new fad industry. She has found her calling in life, something that matches her passion with her skill set and, regardless of where she is in that process, she is excited and confident that she will make money because she has positioned herself for success and she knows this is where she can maximise her earning potential.

Favorite Takeaways – The Smart Money Woman by Arese Ugwu.

In the narrative, Arese captures the picture of a young Nigerian woman, Zuri, whose intellect, educational background, and looks have presented her with great prospects; yet she comes close to losing it all before the realisation that her lifestyle could destroy those same prospects. Whilst the main focus is on Zuri and her journey to financial awakening.

WHAT “BROKE” REALLY MEANS!

In Sub-Saharan Africa, less than one percent are born into wealth and under ten percent are born into the middle class. In general, we are not taught in any formal framework how to keep money or grow it—basic personal finance skills are difficult to learn. As a result, even when a young adult starts earning more than they need to survive, they end up living from paycheque to paycheque because they think about their incomes largely in terms of spending and haven’t learned how to save or build assets in proportion to what they earn.

Broke means, if you lost your primary source of income today, you wouldn’t be able to maintain the lifestyle you have become accustomed to because you have no assets to rely on.

Money Script

There’s a lot of fear surrounding the way African women feel about money and the subsequent consequences of our relationship with money. When it comes to money in relation to our families, our businesses, our friendships, and society, many African women worry about not having enough to survive, not having enough to measure up to the lifestyle of our friends and family, the fear of failing in business, the fear of not being able to afford the lifestyle one has become accustomed to, then losing it all and becoming dependent on others.

Ultimately how we behave with money is deeply rooted in how we think about money and fear can be a very crippling thing; it can stifle you and stop you from taking action to achieve your goals but we must realise that fear is just an emotion. It is worrying about something that has the possibility to occur in the future. Unfortunately, this fear can be paralysing. So sometimes instead of confronting and facing those money fears, we hide from them and avoid them.

TRACK YOUR EXPENSES

Most people don’t know where the money they earn goes. What percentage of your income goes to food? Transportation? Clothes? Just like in any successful business where you track the revenue and costs periodically, it is also important to track the expenses in our personal lives.

We have to learn to spend with intention by allocating our resources to reflect the lifestyle we want and are able to sustainably afford. This all starts with having a clear idea of where the money is going in the first place. You have to give up the excuses and learn to control money instead of letting money control you.

BUILD AN EMERGENCY FUND

We live in a very superstitious society. So, even when we hear the terrible stories of people losing their jobs, or women losing the bread winners of their households suddenly, then forced into relative pennilessness because they can no longer afford their rent and have to beg friends and family for money to pay the children’s school fees, we think ‘God forbid not me’. Sometimes, though, bad things happen to good people. So instead of worrying without action, we need to plan for emergencies.

A smart woman doesn’t wait for financial surprises; she systematically saves toward her emergency fund because she knows that this is the foundation of her financial journey.

DEVELOP A SUSTAINABLE BUDGET

One of the biggest issues people complain about when it comes to their money is not knowing how to save or budget. People associate the word “budget” with scarcity or a reduction in station of life. Therefore, “budget” is a word they come to resent. The reality is, a budget is something that tells you how to allocate your resources and it should reflect what you value.

Money in the bank is equal to spending. It doesn’t matter whether you earn ten thousand or ten million naira a month, your resources are limited and consumption tends to rise with income, so it’s important to have a spending plan that takes that into consideration.

Arese Ugwu’s Smart Money Woman is a very good read as all her characters are relatable. Growing up in Nigeria, we were not taught much about finance at home or in school. You get indoctrinated at home with money scripts such as “We can not afford it”, “Money does not grow on a tree” etc. These money scripts follow us into adulthood – We live from paycheck to check (Zuri), no financial discipline or systems when we start our business (Tami), the financial burden of being the first child/Black Tax (Lara), Family Brouhaha/Drama (Ladun) and Marital Issues (Adesuwa).

All her characters are very relatable as a Nigerian: The Weekly Owambe (Lagos Party), Aso-Ebi(s), Packaging, Living beyond your means, retail therapy, the hustling spirit, the grace of being a Nigerian woman. I really loved the book.

All the Best in your quest to get Better. Don’t Settle: Live with Passion.

1 Comment

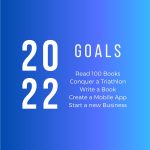

Pingback: 100 Books Reading Challenge 2022. | Lanre Dahunsi