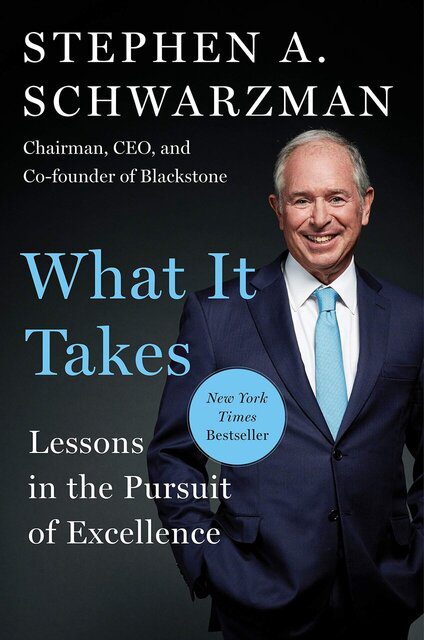

Print | Kindle(eBook) | AudioBook

What It Takes is a biographical book by Stephen A. Schwarzman, Chairman, CEO, and Co-Founder of Blackstone, one of the world’s leading investment firms with over $500 billion in assets under management. Schwarzman is the billionaire philanthropist who founded Schwarzman Scholars, this century’s version of the Rhodes Scholarship, in China.

After starting his finance career with a short stint at U.S. investment bank Donaldson, Lufkin & Jenrette, Schwarzman began working at Lehman Brothers, where he ascended to run the mergers and acquisitions practice. He eventually partnered with his mentor and friend Pete Peterson to found Blackstone, vowing to create a new and different kind of financial institution.

Here are my favourite take-aways from reading, What It Takes: Lessons in the Pursuit of Excellence by Stephen A. Schwarzman:

Schwarzman shares 25 lessons and rules for life and Work:

“The best executives are made, not born. They absorb information, study their own experiences, learn from their mistakes, and evolve.”

- It’s as easy to do something big as it is to do something small, so reach for a fantasy worthy of your pursuit, with rewards commensurate to your effort.

- The best executives are made, not born. They never stop learning. Study the people and organizations in your life that have had enormous success. They offer a free course from the real world to help you improve.

MADE, NOT BORN

In spring 1987, I flew to Boston to meet with the endowment team at the Massachusetts Institute of Technology. I was trying to raise money for Blackstone’s first investment fund and had set a target of $1 billion. This would make us the biggest first fund of our kind and the third biggest in the world. It was an ambitious goal. Most people said it was impossible.

If you’re going to commit yourself to something, it’s as easy to do something big as it is to do something small. Both will consume your time and energy, so make sure your fantasy is worthy of your pursuit, with rewards commensurate to your effort.

But I’ve always believed that it’s just as hard to achieve big goals as it is small ones. The only difference is that bigger goals have much more significant consequences. Since you can tackle only one personally defining effort at a time, it’s important to pursue a goal that is truly worthy of the focus it will require to ensure its success.

it’s just as hard to achieve big goals as it is small ones. The only difference is that bigger goals have much more significant consequences

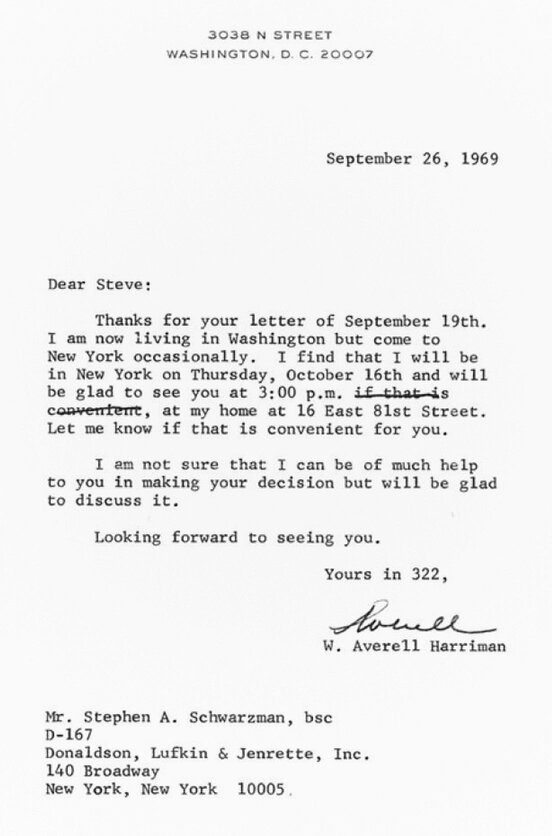

Write or call the people you admire, and ask for advice or a meeting. You never know who will be willing to meet with you. You may end up learning something important or form a connection you can leverage for the rest of your life. Meeting people early in life creates an unusual bond.

At some point in life, we have to figure out who we are, he said. The sooner we do it the better, so we can pursue the opportunities that are right for us, not some false dream created by others. – Averell Harriman advice to Schwarzman

“You can learn to be a manager. You can even learn to be a leader. But you can’t learn to be an entrepreneur.”

Inflection Points

Every entrepreneur knows the feeling: that moment of despair when the only thing you are aware of is the giant gap between where you find yourself and the life and business you imagine. Once you succeed, people see only the success. If you fail, they see only the failure. Rarely do they see the turning points that could have taken you in a completely different direction. But it’s at these inflection points that the most important lessons in business and life are learned.

Once you succeed, people see only the success. If you fail, they see only the failure. Rarely do they see the turning points that could have taken you in a completely different direction.

Listening

A lot of people fail because they start from a position of self-interest. What’s in this for me? They will never get to do the most interesting and rewarding work. Listening closely and watching the way people talk puts me much closer to answering the question I’m always asking myself, which is: How can I help? If I can help someone and become a friend to their situation, everything else follows.

There is nothing more interesting to people than their own problems. If you can find out what they are and come up with solutions, they will want to talk to you no matter their rank or status. The harder the problem and the scarcer the solution, the more valuable your advice is. It’s in those situations, where everyone is walking away with averted eyes, that the field clears and the greatest opportunity awaits.

There is nothing more interesting to people than their own problems. Think about what others are dealing with, and try to come up with ideas to help them. Almost anyone, however senior or important, is receptive to good ideas provided you are thoughtful.

Building Blackstone

“Blackstone is a remarkable success because of our culture. We believe in meritocracy and excellence, openness and integrity. And we work hard to hire only people who share those beliefs. We are fixated on managing risk and never losing money. We are strong believers in innovation and growth—constantly asking questions in order to anticipate events so that we can evolve and change before we are forced to. There are no patents in finance.”

Every business is a closed, integrated system with a set of distinct but interrelated parts. Great managers understand how each part works on its own and in relation to all the others.

“There are no patents in finance. A good business with high profits today can be a poor business with low profits tomorrow. Because of competition and disruption, if all you rely on is a single line of business, your organization may not survive.”

Everything is Connected

The lesson was that everything in business relates to everything else. For a business to succeed, each part has to work on its own and with all the other parts. It’s a closed, integrated system, organized by managers. If you are making cars, you have to have good research so you’ll know what people want to buy; good design, engineering, and manufacturing so you can produce a good product; effective programs to recruit and train your labor force; good marketing so you can create desire for what you are making; and good salespeople who know how to close deals. If any parts in the system break and you can’t fix them quickly, you risk losing money and going out of business.

Cost of Ambition

If you want something badly enough, you can find a way. You can create it out of nothing. And before you know it, there it is. But wanting something isn’t enough. If you’re going to pursue difficult goals, you’re inevitably going to fall short sometimes. It’s one of the costs of ambition.

Businesses often succeed and fail based on timing. Get there too early, and customers aren’t ready. Arrive too late, and you’ll be stuck behind a long line of competitors.

Solving Hard Problems

As an investment banker and later as an investor, I found that the harder the problem, the more limited the competition. If something’s easy, there will always be plenty of people willing to help solve it. But find a real mess, and there is no one around. If you can clean it up, you will find yourself in rare company. People with tough problems will seek you out and pay you handsomely to solve them. You will earn a reputation for doing what others cannot. For a pair of entrepreneurs trying to break through, solving hard problems was going to be the best way of proving ourselves.

Information is the most important asset in business. The more you know, the more perspectives you have, and the more likely you are to spot patterns and anomalies before your competition. So always be open to new inputs, whether they are people, experiences, or knowledge.

- When you’re young, only take a job that provides you with a steep learning curve and strong training. First jobs are foundational. Don’t take a job just because it seems prestigious.

Success is about taking advantage of those rare moments of opportunity that you can’t predict but come to you provided you’re alert and open to major changes.

- When presenting yourself, remember that impressions matter. The whole picture has to be right. Others will be watching for all sorts of clues and cues that tell who you are. Be on time. Be authentic. Be prepared.

Salesmanship

As a salesman, I’d learned you can’t just pitch once and be done. Just because you believe in something doesn’t guarantee anyone else will. You’ve got to sell your vision over and over again. Most people don’t like change, and you have to overwhelm them with your argument, and some charm. If you believe in what you’re selling and they say no, you have to presume that they don’t fully understand, so you give them another opportunity.

No one person, however smart, can solve every problem. But an army of smart people talking openly with one another will.

To be successful you have to put yourself in situations and places you have no right being in. You shake your head and learn from your own stupidity. But through sheer will, you wear the world down, and it gives you what you want.

- Sales rarely get made on the first pitch. Just because you believe in something doesn’t mean everyone else will. You need to be able to sell your vision with conviction over and over again. Most people don’t like change, so you need to be able to convince them why they should accept it. Don’t be afraid to ask for what you want.

People in a tough spot often focus on their own problems, when the answer usually lies in fixing someone else’s.

- Believe in something greater than yourself and your personal needs. It can be your company, your country, or a duty for service. Any challenge you tackle that is inspired by your beliefs and core values will be worth it, regardless of whether you succeed or fail.

- Never deviate from your sense of right and wrong. Your integrity must be unquestionable. It is easy to do what’s right when you don’t have to write a check or suffer any consequences. It’s harder when you have to give something up. Always do what you say you will, and never mislead anyone for your own advantage.

“Regardless of how you begin your careers, it is important to realize that your life will not necessarily move in a straight line. You have to recognize that the world is an unpredictable place. Sometimes even gifted people such as yourselves will get knocked back on their heels. It is inevitable that you will confront many difficulties and hardships during your lives. When you face setbacks, you have to dig down and move yourself forward. The resilience you exhibit in the face of adversity—rather than the adversity itself—will be what defines you as a person.”

- Be bold. Successful entrepreneurs, managers, and individuals have the confidence and courage to act when the moment seems right. They accept risk when others are cautious and take action when everyone else is frozen, but they do so smartly. This trait is the mark of a leader.

- Never get complacent. Nothing is forever. Whether it is an individual or a business, your competition will defeat you if you are not constantly seeking ways to reinvent and improve yourself. Organizations, especially, are more fragile than you think.

- If you see a huge, transformative opportunity, don’t worry that no one else is pursuing it. You might be seeing something others don’t. The harder the problem is, the more limited the competition, and the greater the reward for whomever can solve it.

- Success comes down to rare moments of opportunity. Be open, alert, and ready to seize them. Gather the right people and resources; then commit. If you’re not prepared to apply that kind of effort, either the opportunity isn’t as compelling as you think or you are not the right person to pursue it.

- Time wounds all deals, sometimes even fatally. Often the longer you wait, the more surprises await you. In tough negotiations especially, keep everyone at the table long enough to reach an agreement.

- Don’t lose money!!! Objectively assess the risks of every opportunity.

- Make decisions when you are ready, not under pressure. Others will always push you to make a decision for their own purposes, internal politics, or some other external need. But you can almost always say, “I think I need a little more time to think about this. I’ll get back to you.” This tactic is very effective at defusing even the most difficult and uncomfortable situations.

- Worrying is an active, liberating activity. If channeled appropriately, it allows you to articulate the downside in any situation and drives you to take action to avoid it.

- Failure is the best teacher in an organization. Talk about failures openly and objectively. Analyze what went wrong. You will learn new rules for decision making and organizational behavior. If evaluated well, failures have the potential to change the course of any organization and make it more successful in the future.

- Hire 10s whenever you can. They are proactive about sensing problems, designing solutions, and taking a business in new directions. They also attract and hire other 10s. You can always build something around a 10.

- Be there for the people you know to be good, even when everyone else is walking away. Anyone can end up in a tough situation. A random act of kindness in someone’s time of need can change the course of a life and create an unexpected friendship or loyalty.

- Everyone has dreams. Do what you can to help others achieve theirs.

“Devote your time and energy to the things you enjoy. Excellence follows enthusiasm, and doing anything solely for prestige rarely leads to success. If you have passion for pursuing your dreams; if you persevere; and if you are committed to helping others, you will have a full and consequential life and always have a chance at greatness. And ”

China vs USA – Thucydides Trap

Graham Allison, a Harvard historian, has warned that this process of rebalancing power from West to East contains a trap.

As the United States steps back and China steps up, both powers, and their dependents, will feel unbalanced, out of sync with decades of history, creating a moment when the slightest misunderstanding, resentment, or offense could topple everyone into the trap of war. It happened in the fifth century B.C. when Athens’ rise threatened Sparta. Hence Allison’s name for it, the Thucydides trap, after the Greek historian who wrote the defining history of the Peloponnesian War. It happened in the twentieth century, when Germany threatened the established European order and provoked two world wars. It could happen again if China and the United States cannot find a cooperative, trusting way to manage the shift in political power that must follow the shift in economic power that has already taken place.

President’s Strategic and Policy Forum

My biggest regret from the episode is that this smart, committed group representing the best of American business could have done so much to help the administration and the country. But sparks in a combustible political atmosphere can lead to widespread collateral damage. We all wanted to befriend the situation, to have a voice at the table in the discussion of how to improve life for all Americans, but our engagement in that capacity was no longer possible.

Simple rules for identifying market tops and bottoms:

1. Market tops are relatively easy to recognize. Buyers generally become overconfident and almost always believe “this time is different.” It’s usually not.

2. There’s always a surplus of relatively cheap debt capital to finance acquisitions and investments in a hot market. In some cases, lenders won’t even charge cash interest, and they often relax or suspend typical loan restrictions as well. Leverage levels escalate compared to historical averages, with borrowing sometimes reaching as high as ten times or more compared to equity. Buyers will start accepting overoptimistic accounting adjustments and financial forecasts to justify taking on high levels of debt. Unfortunately most of these forecasts tend not to materialize once the economy starts decelerating or declining.

3. Another indicator that a market is peaking is the number of people you know who start getting rich. The number of investors claiming outperformance grows with the market. Loose credit conditions and a rising tide can make it easy for individuals without any particular strategy or process to make money “accidentally.” But making money in strong markets can be short-lived. Smart investors perform well through a combination of self-discipline and sound risk assessment, even when market conditions reverse.

All investors will tell you that markets are cyclical. Yet many behave as if they don’t know this. In my career, I have seen seven major market declines or recessions: 1973, 1975, 1982, 1987, 1990–1992, 2001, and 2008–2010. Recessions happen.

Herd Behaviour

While most investors say they are interested in making money, they are actually interested in psychological comfort. They would rather be part of the herd, even when the herd is losing money, than make the hard decisions that yield the greatest rewards. Doing what everyone else is doing seems like a way to avoid blame. These investors tend not to invest aggressively near market bottoms, but instead do it at market tops, where it makes little sense. They like the comfort and reassurance of watching assets go up. The higher prices go, the more investors convince themselves that they will continue appreciating. This same phenomenon explains why it’s almost impossible to bring an IPO to market near the bottom of a cycle. But as a cycle grows riper, the number, size, and valuations of IPOs explode.

Failures

For all our entrepreneurial strengths, our drive, our ambition, our skills, and our work ethic, we still weren’t building Blackstone into a great organization. Failures are often the best teachers in any organization. You must not bury your failures but talk about them openly and analyze what went wrong so you can learn new rules for decision making. Failures can be enormous gifts, catalysts that change the course of any organization and make it successful in the future.

All the Best in your quest to get Better. Don’t Settle: Live with Passion.

1 Comment

Pingback: 100 Books Reading Challenge 2021 – Lanre Dahunsi