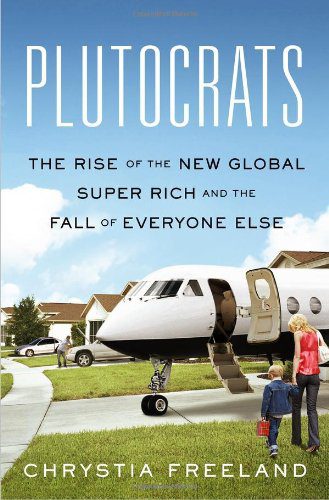

Plutocrats: The Rise of the New Global Super-Rich and the Fall of Everyone Else is a book by Journalist and Canadian Politician Chrystia Freeland. The book’s theme is economic inequality, lives of ultra-high-net-worth individuals, and the rise of the global super-rich.

“This book is about both economics and politics. Political decisions helped create the super-elite in the first place, and as the economic might of the super-elite class grows, so does its political muscle. The feedback loop between money, politics, and ideas is both cause and consequence of the rise of the super-elite. But economic forces matter, too. Globalization and the technology revolution—and the worldwide economic growth they are creating—are fundamental drivers of the rise of the plutocrats. Even rent-seeking plutocrats—those who owe their fortunes chiefly to favorable government decisions—have also been enriched partly by this growing global economic pie.”

“In America, the gap between the top 1 percent and everyone else has indeed developed into “a totally different stratosphere.”

1970s

In the 1970s, the top 1 percent of earners captured about 10 percent of the national income. Thirty-five years later, their share had risen to nearly a third of the national income, as high as it had been during the Gilded Age, the previous historical peak.

Plutonomy refers to a society where the wealth is controlled by a select few and where economic growth becomes dependent on that same wealthy minority. The term was popularized by Citigroup global equity strategist Ajay Kapur and his research team in 2005 to describe the incredible growth of the U.S. economy.

Citigroup – Plutonomy and the rest

In a plutonomy there is no such animal as ‘the U.S. consumer’ or ‘the UK consumer’ or indeed ‘the Russian consumer.’ There are rich consumers, few in number but disproportionate in the gigantic slice of income and consumption they take. There are the rest, the non-rich, the multitudinous many, but only accounting for surprisingly small bites of the national pie.

“In the two hundred years following 1800, the world’s average per capita income increased more than ten times over, while the world’s population grew more than six times. This was something entirely new—as important a shift in how societies worked as the domestication of plants and animals.”

That historically unprecedented surge in economic prosperity was the result of the industrial revolution. Eventually, it made all of us richer than humans had ever been before—and opened up the gap between the industrialized world and the rest, which only now, with the rise of the emerging market economies two hundred years later, can we start to imagine might ever be closed.

THE CHINA SYNDROME

In communities hit by the China Syndrome, wages fall—particularly, it turns out, outside the manufacturing sector—and some people stop looking for work. The result is “a steep drop in the average earnings of households.” Uncle Sam gets hit, too, especially in the form of increased disability payments.

The Ultra Wealthy

In 2011, in its annual report on the world’s rich, Credit Suisse, the international investment bank, noted that the number of super-rich—whom it delicately dubs “ultra high net worth individuals,” or UHNWIs, with assets above $50 million—surged: “Although comparable data on the past are sparse, it is almost certain that the number of UHNW individuals is considerably greater than a decade ago.

Overall, Credit Suisse calculated that there were about 29.6 million millionaires—people with more than $1 million in net assets—in the world, about half a percent of the total global population. North Americans are no longer the largest group—they account for 37 percent of the world’s millionaires, slightly fewer than the 37.2 percent who are European. Asia-Pacific, excluding China and India, is home to 5.7 million (19.2 percent), while there are just over 1 million in China (3.4 percent). The remaining 937,000 live in India, Africa, or Latin America.

There were 84,700 UHNWIs in the world in 2011, of whom 29,000 owned net assets worth more than $100 million, and of whom 2,700 were worth half a billion dollars

A total of 37,500 UHNWIs are in North America (44 percent); 23,700 (28 percent) are in Europe; and 13,000 are in Asia-Pacific excluding China and India (15 percent).

When it comes to super-wealth, the United States is unassailably at the top. America is home to 42 percent of all UHNWIs, with 35,400. China is in second place, with 5,400, or 6.4 percent of the total, followed by Germany (4,135), Switzerland (3,820), and Japan (3,400). Russia has 1,970, India 1,840, Brazil 1,520, Taiwan 1,400, Turkey 1,100, and Hong Kong 1,030.

In 2009, the country’s top twenty-five hedge fund managers earned an average of more than $1 billion each—or more than they had made in 2007, the previous record year.

Bullingdon Club

The plutocrats are becoming a transglobal community of peers who have more in common with one another than with their countrymen back home. Whether they maintain primary residences in New York or Hong Kong, Moscow or Mumbai, today’s super-rich are increasingly a nation unto themselves.

There’s Davos. There’s the Oscars. There’s the Cannes Film Festival. There’s Sun Valley. There’s the TED conference. There’s Teddy Forstmann’s conference. There’s UN Week, Fashion Week. In London, there is Wimbledon Week, which is the last week of June.

World Economic Forum’s annual meeting in Davos, Switzerland

The best known of these events is the World Economic Forum’s annual meeting in Davos, Switzerland, invitation to which marks an aspiring plutocrat’s arrival on the international scene—and where, in lieu of noble titles, an elaborate hierarchy of conference badges has such significance that one first-time participant remarked that the staring at his chest made him realize for the first time what it must be like to have cleavage.

The Bilderberg Group

The Bilderberg Group, which meets annually at locations in Europe and North America, is more exclusive still—and more secretive—though it is more focused on geopolitics and less on global business and philanthropy.

The Boao Forum

The Boao Forum, convened on Hainan Island each spring, offers evidence both of China’s growing economic importance and of its understanding of the culture of the global plutocracy.

Schooling

The globalization of the super-elite starts before the deals do—in school. The plutocracy doesn’t have its own passport, but it does have its alma maters—America’s Ivy League, plus Stanford and Oxbridge, and the world’s top business schools, mostly an American group, but also including Europe’s INSEAD.

“China’s plutocrats, who devote more than a fifth of their annual spending to their children’s education, are enthusiastic globalizers”

Elite Lawyers – David Boies

Boies and his eponymous firm earned a reputed $100 million for the nine-month job of defending Greenberg. That was one of the richest fees earned in a single litigation. Yet, for Greenberg, it was a terrific deal. When you have $4.3 billion at risk, $100 million—only 2.3 percent of the total—just isn’t that much money. (Further sweetening the transaction was the judge’s eventual ruling that AIG, then nearly 80 percent owned by the U.S. government, was liable for up to $150 million of Greenberg’s legal fees, but he didn’t know that when he retained Boies.)

Working for the Plutocrats

Whether your skill is tooth enamel or fabric swatches, if you make it into the superstar league you can benefit from the concentration of wealth in the hands of a small, global business elite. And whether you got your start in western Siberia or the American Midwest, once you join the super-elite you patronize the same dentist, interior designer, art curator. That’s how, from the inside, the plutonomy becomes a cozy global village.

The billionaire’s circle

That phrase—the billionaire’s circle—is the key to how the entrepreneurs of finance transformed the wider culture of Wall Street, and thus of the global banking business. To understand how that sentiment has ratcheted up individual compensation for Wall Street’s salarymen—not just the entrepreneurs who take the risk of going it alone—consider this fact:

In 2011, 42 percent of Goldman Sachs’s revenues were spent paying its employees, who earned an average of $367,057. Nor is that princely compensation restricted to the über-bankers at Goldman Sachs.

At Morgan Stanley, which made a $4 billion mistake on the eve of the financial crisis and whose recovery from it has been lackluster, compensation accounted for 51 percent of revenue in 2010.

At Barclays, which now owns Lehman, the figure was 34 percent; at Credit Suisse, it was 44 percent.

To put it another way, on Wall Street, in the battle between talent and capital, it is the talent that is winning.

Wall Street is the mother church of capitalism. But its flagship firms are run like Yugoslav workers’ collectives.

THE MATTHEW EFFECT

We are all familiar with the Matthew effect in pop culture, where it is so apparent that it seems as inevitable and unremarkable as gravity. Celebrities are famous for being famous. And fame is its own achievement and currency. One reason we know that is because of fame production machines, like reality TV shows, and the intense popular desire to participate in them. (In Philadelphia in August 2007, twenty thousand people competed for twenty-nine spots on American Idol, a far tougher ratio than being admitted to Harvard.)

Public School and Ivy League

Revolution is the new global status quo, but not everyone is good at responding to it. My shorthand for the archetype best equipped to deal with it is “Harvard kids who went to provincial public schools.” They got into Harvard, or, increasingly, its West Coast rival, Stanford, so they are smart, focused, and reasonably privileged. But they went to public schools, often in the hinterlands, so they have an outsider’s ability to spot the weaknesses of the ruling paradigm and don’t have so much vested in the current system that they are afraid of stepping outside it.

Facebook’s Mark Zuckerberg (New York State public school, Harvard), Blackstone cofounder Steve Schwarzman (Pennsylvania public school, Yale undergraduate, Harvard MBA), and Goldman Sachs CEO Lloyd Blankfein (Brooklyn public school, Harvard) are literal examples of this model. Most of the Russian oligarchs—who were clever and driven enough to get degrees from elite Moscow universities before the collapse of the Soviet Union, but were mostly Jewish and therefore not fully part of the Soviet elite—have a similar insider/outsider starting point. Soros, the worldly and well-educated son of a prosperous Budapest lawyer, who was forced by war and revolution to make his own way in London and New York, is another representative of the genre.

Finance Industry

Much of the story of the rise of the 1 percent, and especially of the 0.1 percent, is the story of the rise of finance. And less regulation, more complexity, and more risk are important reasons why finance has become a bigger part of so many developed Western economies, particularly the United States and the United Kingdom, and why financiers’ income has overtaken that of almost everyone else.

Wider studies of the 0.1 percent tell the same story. One of the most comprehensive analyses of who is in that top slice found that, in 2005, 18 percent of the plutocrats were in finance. As the Harvard data suggested, that number has grown sharply in recent decades, up from 11 percent in 1979. The only occupation that accounts for a bigger share of the income at the very top is the CEO class. Moreover, within the generally prospering community of the 0.1 percent, the incomes of bankers are growing the fastest of all.

All the Best in your quest to get Better. Don’t Settle: Live with Passion.

1 Comment

Pingback: 100 Books Reading Challenge 2021 – Lanre Dahunsi